There is in interesting game of chicken going on in the airline industry right now. Should airlines sell all of the seats on their flights or block some to help keep people a little further apart for now?

No one seriously thinks that you can properly socially distance on an airplane, but wearing masks and having an empty seat next to you does add to the sense that the risk is not high, especially compared to other areas with close gatherings.

Gordon Bethune, the successful CEO of Continental Airlines back in the 1990s, used to say that airline industry was only as smart as its dumbest competitor. He used this statement often in regards to pricing, when frustrated that other airlines would run a fare sale at times he felt demand was in the airlines’ favor. Now, is it fair to say that those blocking seats are being dumb or that those selling all their seats are being dumb? It depends on how far ahead you are thinking.

I wrote earlier that one of the main priories for airlines today is to win back confidence of the flying consumers. I have flown three times in the last three weeks, and have told dozens of people about my trips. Since my experiences were mostly positive, I have no doubt that this has affected the view of others to some extent. Conversely, had a I told them about packed planes and lack of compliance to mask wearing, I bet that they would have had a different reaction. This is why I believe that some airlines are playing the long game while others are playing the short game.

The short game is to maximize earnings and cash right now. Sell every seat you can, and since airline marginal costs are low that means even low fares are better than empty seats. This will maximize current month and quarter revenue for sure, but at what cost? When TripAdvisor and other sites show complaints about full planes and perceived risk onboard American, United or Spirit, is this the best way to bring demand back quickly? Compare that to those who fly Alaska, Delta, JetBlue, or Southwest, all of whom are holding to seat blocks onboard. The view from customers on these flights will likely win over those still skittish about flying. This is the long game, as getting back to pre-Coronavirus demand is the best thing for the whole industry. Some flights will fill today for sure, but a majority are still running 50%-60% full. This means the cost to build confidence is low, while the upside to sell everything is not as compelling.

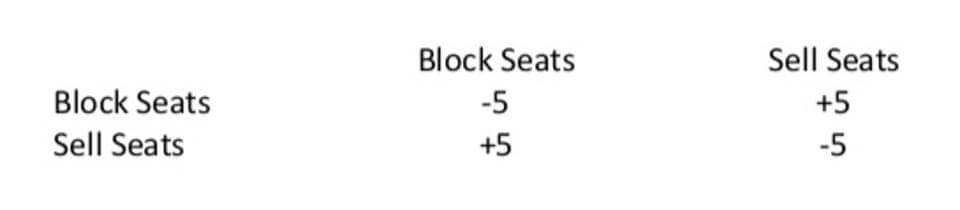

Let’s try to model this using a game theory payoff matrix. Here is what I select for a 30-day return for the industry, assuming two airlines each make an independent decision to sell all seats or block some seats:

30-Day Payoff Matrix

30-Day Payoff Matrix for Airline Industry (Ben Baldanza)

This shows that if both airlines block seats, the industry will be short some revenue because they forego the revenue from the blocked seats. But, if one airline sells seats while the others block, they get a small gain because their revenue grows while the other is constrained. In 30 days, the change in consumer confidence will be small, making selling the seats logical for some but the cost low for those who block also. But what about the six month effects? Here is my view of that payoff:

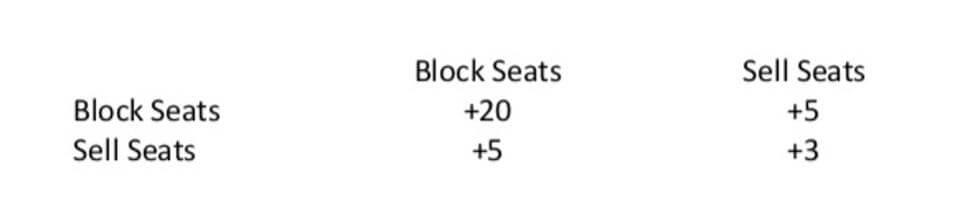

Six Month Payoff Matrix

Six month payoff matrix for airlines choosing to block seats or sell all seats. (Ben Baldanza)

This shows that over a longer period, both airlines choosing to block seats now encourages a much faster recovery of total demand. So, each airline earns the largest payoff over this time. If both airlines sell seats over the next six months, their return is positive but at a much smaller rate, because many consumers still choose not to fly because of their fear of full planes.

Ok, I recognize that you can make these payoffs whatever you want to make the point you want to make. I think these are reasonable in a relative sense, and airlines won’t get strong demand back until consumers are confident that they can be safe onboard. That means that each actual experience for the next few months has outsized importance for determining broad consumer confidence. This is clearly what Alaska, Delta, JetBlue, and Southwest are thinking, and I agree with them. I understand what United, American, and Spirit are doing, and accept that they may think their actions today have little to no affect on long term industry demand. I disagree with that view.

Interestingly, this debate seems to be only happening in the US. A just released report by CarTrawler and IdeaWorks shows how 25 airlines around the world are addressing the coronavirus issue. No where else in the world are people asking for middle seats to be blocked. With so much uncertainty about the future and what the long term demand trends for the airline industry will be, it seems that airlines should be doing everything possible to make customers comfortable for the short and long game.

This article first appeared on Forbes.com

Title image by Lucrezia de Agrò on Unsplash