Disclaimer: The January 2018 Airbus-Emirates A380 deal was widely covered in the press with different analysts’ opinions. This article is an original game theory take on the topic and the strategies we discuss may or may not have been deployed by the involved parties. TWS Partners presents a plausible account of events for free educational purposes.

ONE-TO-ONE NEGOTIATIONS: THE BIGGER PICTURE

One-to-one negotiations are often perceived as arm-wrestling contests in which the competitor who is able to handle the pressure will drop last. However, the truth is that the winner is usually the one who can better foresee the different outcomes’ successions and act accordingly.

One-to-one negotiations often take place in larger circles in which non-participants are likely to have a dramatic influence on the negotiation’s outcome. Sell a chair with a discount to your neighbour today, and you’d probably have to match that price to any other customer in the neighbourhood. Furthermore, the time horizon is game critical, since the involved parties may have already negotiated before, and/or are likely to negotiate again in the future. If you were not to meet again, you would rather maximise and not compromise.

Consideration of these factors constitutes game-theoretical thinking. As eloquently defined by Sebastian Moritz, partner at TWS Partners, game theory is the ‘scientific modelling of interactions between different parties in competitive situations’.

GAME THEORY AND THE AIRBUS-EMIRATES MULTI-BILLION DOLLAR DEAL

On 18 January 2018, Airbus and Emirates agreed a $16 billion (current market price) deal for up to 36 A380 aircraft, Airbus’ largest and most expensive commercial plane. This deal was however, preceded by a delicate series of closed-door negotiations.

Emirates is Airbus’ largest and predominant customer for the A380 range, with 101 operating planes. At the same time, Emirates has built its service’s future strategy almost entirely on this range of aircraft. Huge investments have been made by the airline company in the form of maintenance equipment, spare parts and qualified personnel. On the other hand, Airbus’ investments were also significantly high in terms of research and development. Clearly, both parties are heavily dependent on each other in respect of the A380.

In such situations of heavy dependency, the bargaining power’s direction is ambiguous and unstable, and each company will try to influence the situation to its advantage.

Looking at the time frame preceding the deal, it has been commonly assumed that Emirates stopped placing orders for a certain time with the aim of putting pressure on Airbus to get a significant discount. At the same time, Airbus had presumably communicated to Emirates that it would stop producing the A380 and completely shut down the production line, should it not receive additional high-volume orders.

Should these assumptions hold, both parties are said to have engaged in a “chicken game”, a famous game theory framework that models situations where both parties have no incentives to cooperate.

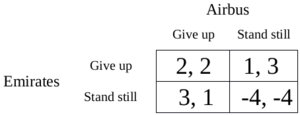

The following scores matrix gives a good overview of the chicken game (also known as the Hawk–Dove game):

The scores’ values are ordinal and not cardinal.

In each cell, the score on the left is for Emirates and the score on the right is for Airbus.

Clearly, both companies would like to “stand still” while the other “gives up”. The scenario where both “give up” could be equivalent to Emirates and Airbus compromising on a volume order with a respective medium-sized discount. On the other hand, the scenario of both “standing still” could refer to the case where Emirates does not place any orders and Airbus shuts down the A380 line. The latter scenario is the worst for both parties as they will each incur high sunk costs. Following the same logic, the case where Emirates “stands still” and Airbus “gives up” is similar to Airbus agreeing to an aggressive discount and Emirates placing the order volume that better suits its financing strategy. Finally, the case where Emirates “gives up” and Airbus “stands still” is the case where Emirates places a high quantity order without any discount.

THE CHICKEN GAME, HOW DID IT END?!

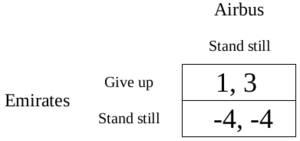

Referring to the above framework, if Emirates believed that Airbus was bluffing about standing still, it certainly would stand still. Knowing that would be the case, Airbus made its “shutdown” threat credible by taking it to the public! In fact, Airbus openly communicated to the press that the survival of the A380 line would be solely dependent on Emirates’ decision to place more significant orders. By doing so, Airbus committed itself to the stand still option, leaving Emirates in a very hard situation. This new situation is equivalent to the scores matrix being shrunk down to the following:

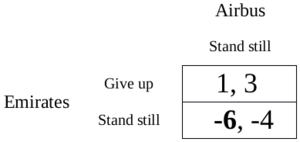

Furthermore, Airbus shutting down the A380 means that Emirates would have to source a substitute product from a market that suddenly changed from a duopoly (a market where only two entities dominate the supply side of the market) to a monopoly (a market where only one entity dominates the supply side of the market). In other words, Emirates will be left to the mercy of Boeing, which is aware of the A380 shutdown news. The prices of the Boeing 747 and 777, closest substitutes of the A380, are therefore expected to increase significantly should the A380 shutdown take place!

For Emirates, the cost of standing still is now even higher with the external parties’ anticipation and the respective scores matrix could be translated as:

Making its threat public, Airbus not only succeeded to secure more volume from Emirates, but also in negotiating new deals with British Airways and Singapore Airlines. By making its threat credible, Airbus changed the buyers’ anticipation of their future bargaining power.

The massive $16 billion order from Emirates could be interpreted as purchasing a “freedom ticket”. Emirates is probably aiming at extracting the most value out of its already made investments, to retrieve flexibility and bargaining power in a few years’ time.

Game theory allows the understanding of anticipation with regards to different threats and incentives. And once again, its economic applications are proven to be immense.

SOURCES:

Topham, G. (2018, January 18). Airbus Finally Secures Lifeline for A380 with Emirates Deal. Retrieved from: www.theguardian.com/business/2018/jan/18/airbus-secures-a380-deal-emirates-gulf-airline-superjumbo

Tsang, A. (2018, January 18). Emirates Offers A380 a Lifeline, Signing $16 Billion Deal with Airbus. Retrieved from: www.nytimes.com/2018/01/18/business/airbus-a380-emirates.html

Hepher, T. (2017, December, 27). Airbus Ready to Phase out A380 if Fails to Win Emirates Deal. Retrieved from: www.reuters.com/article/us-airbus-a380/airbus-ready-to-phase-out-a380-if-fails-to-win-emirates-deal-sources-idUSKBN1EL11L

Schelling, T. C. (1960) The Strategy of Conflict. Cambridge, MA: Harvard Univ. Press.