The system of carbon offset credits has been under fire for years. A recent article by DIE ZEIT and The Guardian hints at the extent of the system’s failure. We have looked at the market from a game theoretical perspective to analyse the flaws and how it can be improved.

The fight against climate change is now very real in the world of business. Feeling the pressure from regulators, investors, customers & employees, almost all companies have committed to “net zero” roadmaps. Net zero means not having a net negative effect on the climate: companies promise to compensate the carbon emissions they cannot avoid by buying carbon credits. These carbon credits act as compensation for emissions by investing in carbon reducing projects elsewhere in the world – e.g. by reforestation in South America or solar energy projects in Africa. This is also called carbon offsetting.[1]

Carbon offsetting is like a diet

In theory, the idea of carbon offsetting sounds reasonable. Indeed, it’s not much different from a diet: reducing calorie intake as the most straightforward approach and then doing sports to compensate for a few extra calories. However, if you put on fancy sports clothes, go to the gym, and only watch other people doing sports while you drink some cucumber water[2], the compensation effect will be, most likely, negligible. And it seems that “cucumber water-gym memberships” have found their way into the world of carbon offsetting.

A recent article by DIE ZEIT and The Guardian provides evidence that a substantial portion of the carbon credits issued by Verra, by far the world’s largest certifier of carbon credits, seem to be entirely worthless (Fischer & Knuth, 2023). Apparently, Verra has vastly overestimated the amount of carbon credits that should be assigned to certain projects – particularly those projects claiming to prevent deforestation.

Why is the current system doomed to fail?

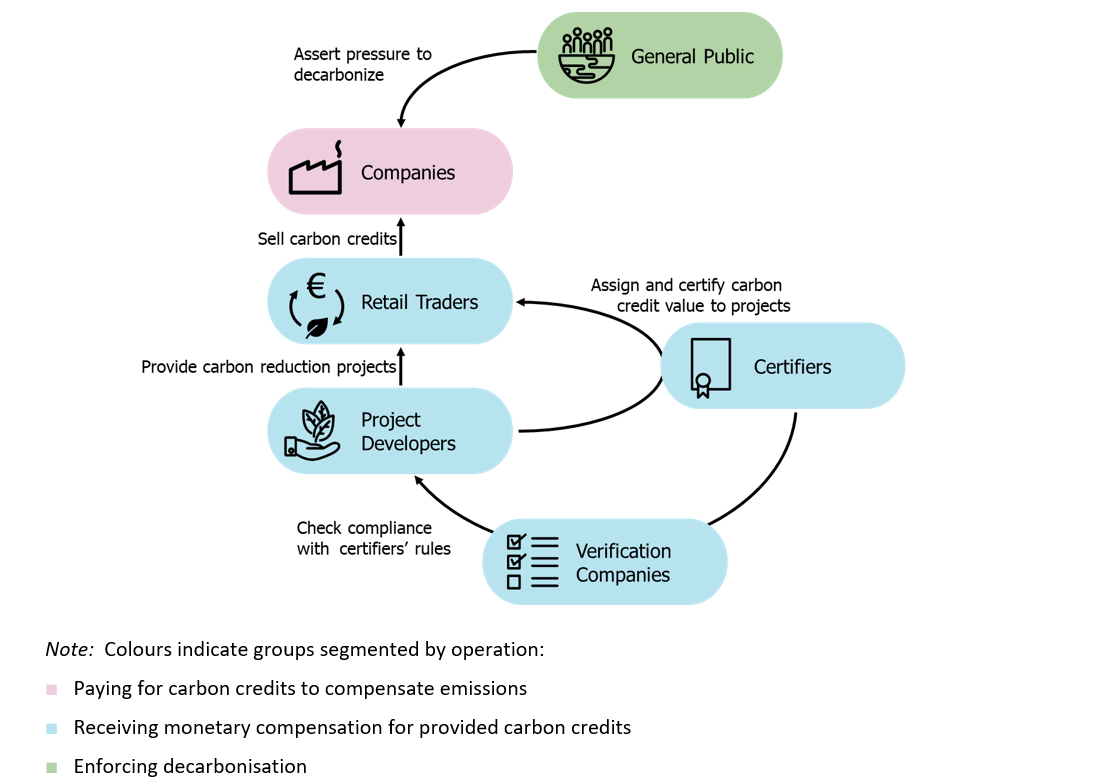

So let’s look at carbon offsetting from a game-theoretical perspective. Let’s first check what different players we have in the carbon offsetting game (see Figure 1).

Figure 1

The Players in the Voluntary Offsetting Process

Firstly, there are the regulators, investors, customers, and employees who put pressure on companies to decarbonise. For simplicity, let’s call them ‘the general public’. Then there are the companies who buy carbon credits to become net-zero on paper – basically every large company in the world. They buy from retail traders who broker and sell those credits. Project developers ensure credits are put into the market by offering carbon reduction opportunities, e.g., by preventing a forest area from being cleared. Then, there are the certifiers (such as Verra) who define how many carbon credits a certain project is worth. The certifiers set the main rules of the carbon offsetting game and they are ultimately responsible for the purchase of one carbon credit equalling a saving of one tonne of carbon. Lastly, there are verification companies who check whether project developers comply with the rules the certifiers have implemented.

Now let’s have a look at the incentives of the different players.

Companies want to become net-zero at the lowest possible cost – hence, carbon credits have to be available in high quantities and as cheaply as possible

Don’t get us wrong – as economists we support the idea of achieving goals at the lowest possible cost. But the jury is still out on whether true net-zero can be achieved within the current system.

Firstly, the pure existence of carbon credits may give some companies an incentive to shift their focus from reducing their own emissions to buying themselves out, according to the principle: “Carbon reductions – yes! But not in my backyard.”

Secondly, there is little incentive for companies to pay high premiums for carbon credits with maximum reputation. On paper, each carbon credit saves one tonne of carbon, and since certificates cannot be distinguished as ‘good’ or ‘bad’ in the eyes of the general public, companies will simply try to minimise their cost.

Retail traders are under pressure to offer a vast amount of carbon credits – to the detriment of quality control

Retail traders are incentivised to sell as many carbon credits as possible. At the same time, there is little visibility in the market of the quality of credits. Hence, retail traders have an incentive to put more and more credits into the market, and if in doubt, to not question the legitimacy of the underlying project.

Project developers can exploit the desperate demand for carbon credits by inventing projects that are not actually reducing carbon emissions

Take for example landowners who own a substantial forest area. They hear how much money there is in the carbon credit business and are incentivised to threaten: “I am going to cut my forest down. Unless, of course, you reimburse me for not doing it!” Project developers can turn this into a “project”, reimburse the landowner and issue carbon credits for “saving the forest”. The landowner, however, may never have had a true intention to cut the forest down in the first place.

Certifiers are not government agencies and earn their own share in the carbon credit business. The rules they set up are therefore as loose as the market tolerates.

Like retail traders, certifiers are paid by the number and size of projects they certify (license fees). They don’t have any incentive to define strict rules, but only to fulfil the bare minimum such that the credits are credible enough to survive in the market.

Verification companies have no interest in challenging the certifier’s rules.

The job of a verification company is to make sure project developers calculate the carbon impact of their projects according to the certifier’s rules – and not to make additional efforts to challenge whether the rules make sense.

What is this all leading to?

- Certifiers set up lax rules opening the floodgates to overvaluation of projects.

- Project developers “invent” carbon reduction projects or overestimate the impact of projects.

- Verification companies only check whether a project impact is calculated in line with the certifier’s rules and not whether the rules make sense in the first place.

- Retail traders don’t check the validity of projects.

- Companies accelerate their net zero roadmap by buying phony credits which don’t reduce as much carbon as they promise.

Every player seems to win – except for the only player with a genuine interest that carbon offsetting really does what it promises: The general public, or in other terms: the climate.

What we see is, in game-theoretical terms, a classical principal-agent problem: the principal (= the general public) hires the agent (= other players in the offsetting market) to contribute to the fight against climate change. However, due to asymmetric information, the principal cannot ensure that the agent is acting in the principal’s best interests.

What could be done better?

The key problem seems to be the rules according to which alleged carbon reduction projects become certified.[3] Here are three options as to how this could be improved:

- Impose strict & transparent rules: A consistent, less complex, and stricter ruleset needs to be imposed by the only player who is currently not benefitting: The general public, in the form of regulators or government agencies.

- Limit asymmetric information: The principal needs to know what the agents offer. Credit buyers and the general public need to be able to refer to a reliable rating system that allows to evaluate the trustworthiness of carbon credits.

- Avoid disputed project types: If the climate benefit is too difficult to verify, it may be the best option to avoid such projects altogether. The German credit retail trader, atmosfair, for instance, abdicates forest projects entirely as they currently classify these as too uncertain.

Carbon offsetting can be an important factor in the fight against climate change. But let’s be realistic – not all emissions are avoidable, not even in the next 10 or 20 years – so to some extent carbon offsetting is even inevitable to help us become net zero. But the system clearly needs to be revised. Offsetting calories by drinking cucumber water should not be an option anymore – it is high time for the treadmill!

[1] Carbon offsetting should not be confused with emission trading systems such as the EU ETS, where companies trade emission allowances (‘certificates’) which are required to be entitled to emit carbon.

[2]Just to add some Hollywood clichés

[3] Interestingly, these rules have largely been developed by those players who benefit from the current system most: certifiers have reached out for the support of NGOs, project developers and credit buyers like Shell.